Page Contents

ToggleMost small businesses use QuickBooks for their accounting needs. It is popular due to its robust features and user-friendly interface.

QuickBooks is the go-to accounting software for many small businesses, offering essential tools for financial management. Its comprehensive features include invoicing, expense tracking, and financial reporting, which are crucial for small business operations. The software is designed to be intuitive, making it accessible even for those without extensive accounting knowledge.

Additionally, QuickBooks offers cloud-based options, allowing business owners to manage their finances from anywhere. This flexibility and ease of use contribute to its widespread adoption among small businesses. Other notable options include Xero, FreshBooks, and Zoho Books, but QuickBooks remains a top choice due to its reliability and extensive support network.

Small Business Accounting Software Landscape

The accounting software landscape for small businesses is diverse. Various solutions cater to different needs. Small businesses often select software based on ease of use, features, and price. Popular options offer robust features at affordable prices. Let’s explore the market.

Market Dominance

QuickBooks is a dominant player in the small business accounting software market. It offers comprehensive features for financial reporting, invoicing, and expense tracking. QuickBooks is suitable for small to medium-sized businesses.

Another significant player is Xero. This cloud-based software provides real-time financial data and is known for its user-friendly interface. Xero is popular among small business owners who prefer simple, yet powerful tools.

FreshBooks also holds a considerable market share. It is designed for freelancers and small business owners who need easy invoicing and expense tracking solutions. FreshBooks provides intuitive reports and live insights.

Emerging Trends

Small business accounting software is evolving. Automation is a key trend. Many modern solutions offer automated bookkeeping and live insights. This saves time and reduces errors.

Another trend is AI integration. AI helps in generating intuitive reports and offering smart financial advice. Digits is one such software that uses AI to deliver detailed financial insights quickly.

Cloud-based solutions are also trending. They provide real-time access to financial data from any device. This ensures business owners can manage their accounts on the go. Zoho Books and Wave are popular cloud-based options.

Here is a quick comparison of some leading accounting software:

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks | Invoicing, Expense Tracking, Financial Reporting | Small to Medium Businesses |

| Xero | Real-time Data, User-friendly Interface | Small Business Owners |

| FreshBooks | Invoicing, Expense Tracking, Live Insights | Freelancers, Small Business Owners |

| Zoho Books | Cloud-based, Real-time Access | Small Businesses |

| Digits | AI Integration, Financial Insights | Startups |

Credit: www.smb-gr.com

Critical Features In Accounting Software

Small businesses rely on accounting software to manage their finances efficiently. Choosing the right software involves understanding the critical features it offers. This section explores some of these essential features, helping you make an informed decision.

Financial Reporting Capabilities

One of the most important features of accounting software is its financial reporting capabilities. Businesses need comprehensive reports to make informed decisions. Look for software that offers:

- Balance Sheets

- Income Statements

- Cash Flow Statements

- Customizable Reports

These reports provide insights into the financial health of your business. Customizable reports allow you to tailor the information to your needs, making it easier to understand and act upon.

Invoicing And Expense Tracking

Efficient invoicing and expense tracking is crucial for small businesses. The right software should help you create, send, and manage invoices seamlessly. Key features to look for include:

- Automated Invoicing

- Expense Categorization

- Receipt Scanning

- Payment Reminders

Automated invoicing saves time and reduces errors, while expense categorization helps track where your money goes. Receipt scanning and payment reminders ensure that no expense is overlooked, and payments are received on time.

Top-rated Accounting Software For Small Businesses

Small businesses need reliable accounting software to manage their finances. Choosing the right tool can save time and reduce errors. Here are the top-rated accounting software options for small businesses.

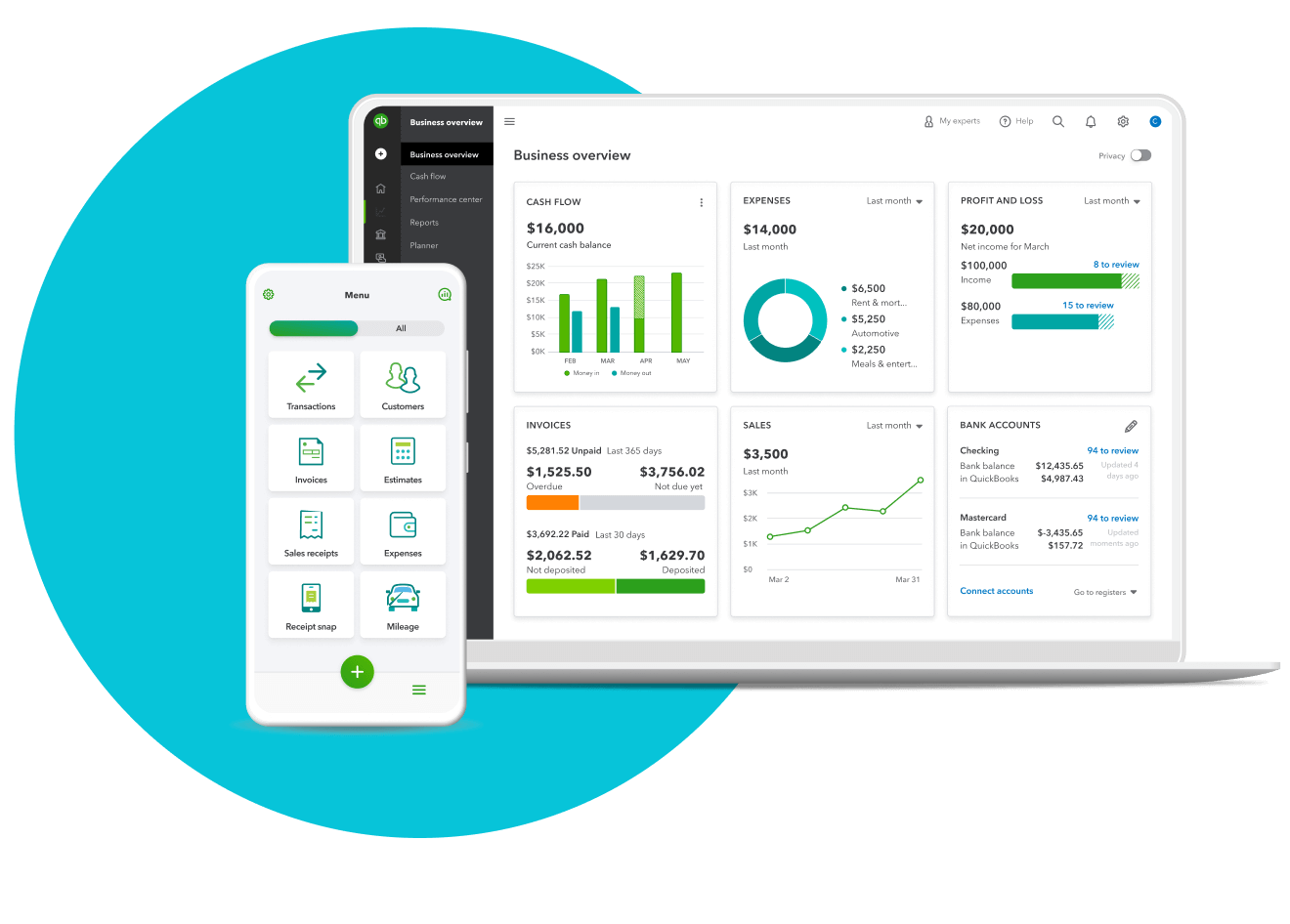

Quickbooks: The Popular Choice

QuickBooks is the most popular accounting software among small businesses. It offers comprehensive features for financial reporting, invoicing, and expense tracking.

- Easy to use

- Accessible on any device

- Comprehensive financial reports

QuickBooks helps small businesses manage payments, invoicing, and expenses efficiently. It supports multiple users and integrates with many third-party apps.

Xero: The Cloud-based Alternative

Xero is a cloud-based accounting software that provides robust features for small businesses. It simplifies bookkeeping and financial management.

- Real-time data access

- Bank reconciliation

- Customizable invoices

Xero supports multiple currencies and offers a mobile app for on-the-go access. It integrates with over 800 business apps.

Freshbooks: Simplified Invoicing

FreshBooks focuses on simplified invoicing and time tracking. It’s ideal for freelancers and small business owners.

- Easy-to-use interface

- Automated invoicing

- Expense tracking

FreshBooks offers features like project management and client collaboration. It ensures timely payments with automated reminders and late fee options.

| Software | Best For | Key Features |

|---|---|---|

| QuickBooks | Comprehensive Accounting | Financial Reports, Invoicing, Expense Tracking |

| Xero | Cloud-Based Management | Real-Time Data, Bank Reconciliation, Multi-Currency |

| FreshBooks | Simplified Invoicing | Automated Invoicing, Time Tracking, Expense Management |

Affordable Accounting Solutions

Small businesses often seek affordable accounting software to manage their finances. Choosing the right solution can save time and money. Below are some popular and cost-effective options.

Zoho Books: Budget-friendly

Zoho Books is a popular choice for small businesses. It offers an array of features at a reasonable cost. Zoho Books supports:

- Invoicing

- Expense tracking

- Bank reconciliation

- Financial reporting

Its user-friendly interface makes it easy to navigate. The software integrates with other Zoho products, enhancing its functionality.

| Feature | Zoho Books |

|---|---|

| Monthly Cost | $9 – $29 |

| Free Trial | Yes, 14 days |

Wave: Free And User-friendly

Wave is ideal for small businesses on a tight budget. It offers core accounting features for free:

- Invoicing

- Expense tracking

- Bank reconciliation

- Basic financial reporting

Wave’s intuitive interface simplifies financial management. It also includes a mobile app for on-the-go access.

| Feature | Wave |

|---|---|

| Monthly Cost | Free |

| Free Trial | Not applicable |

Accounting Software For Scaling Businesses

As small businesses grow, their accounting needs become more complex. Choosing the right accounting software is crucial for scaling. Here, we explore two popular options that cater to growing businesses: Sage 50cloud and NetSuite.

Sage 50cloud: Advanced Features

Sage 50cloud combines desktop software with cloud access. It offers advanced features that are ideal for scaling businesses.

- Inventory Management: Track inventory levels and manage stock efficiently.

- Job Costing: Calculate the cost of jobs and projects for better budgeting.

- Cash Flow Management: Monitor your cash flow in real-time to make informed decisions.

- Multi-Currency: Handle transactions in multiple currencies effortlessly.

The software also integrates with popular Microsoft Office 365 tools. This integration enhances productivity and collaboration within your team.

Netsuite: Enterprise-level Operations

NetSuite is an enterprise-level solution designed for businesses aiming for extensive growth. It offers robust features for comprehensive management.

- Financial Management: Streamline your financial operations with advanced reporting tools.

- Order Management: Automate and manage your order processing efficiently.

- CRM Integration: Integrate customer relationship management to enhance customer service.

- Global Business Management: Manage multiple subsidiaries, legal entities, and business units.

| Feature | Sage 50cloud | NetSuite |

|---|---|---|

| Inventory Management | Advanced | Robust |

| Job Costing | Yes | No |

| Multi-Currency | Yes | Yes |

| CRM Integration | No | Yes |

Both Sage 50cloud and NetSuite offer unique benefits for growing businesses. Selecting the right software depends on your specific needs and future growth plans.

:max_bytes(150000):strip_icc()/GettyImages-1442731807-de72b6667831444298d539e63d58693f.jpg)

Credit: www.investopedia.com

Comparing Costs: Investments Vs. Returns

Choosing the right accounting software for your small business involves more than just evaluating features. Understanding the costs associated with each option and the potential returns can help you make an informed decision. Let’s break down the pricing structures and assess the long-term return on investment (ROI) of popular accounting software.

Understanding Pricing Structures

Accounting software often comes with different pricing models. Some may charge a monthly subscription, while others offer a one-time purchase.

- Monthly Subscriptions: These plans usually range from $10 to $60 per month. They often include updates and customer support.

- One-Time Purchase: This model typically costs between $200 and $600. It may require additional fees for updates and support.

- Free Versions: Some software offers limited free versions. These are suitable for very small businesses with basic needs.

Consider your business size and needs to choose the best pricing structure.

Assessing Long-term Roi

Investing in accounting software is not just about the upfront costs. Assessing the long-term ROI is crucial.

| Software Type | Initial Cost | Annual Cost | Estimated ROI |

|---|---|---|---|

| QuickBooks Online | $20/month | $240/year | High (due to automation and efficiency) |

| Xero | $12/month | $144/year | Medium (good for small to medium businesses) |

| FreshBooks | $15/month | $180/year | High (excellent invoicing features) |

| Wave | Free | $0/year | Low (limited features) |

ROI depends on how well the software fits your business needs. Automation features, ease of use, and customer support can significantly impact the ROI.

Evaluating these factors helps ensure you make a cost-effective decision.

Ease Of Use And Accessibility

Small businesses often seek accounting software that balances functionality with ease of use. Accessibility is also crucial, enabling users to manage their finances from anywhere. Let’s explore these factors in more detail.

User Interface

A clean and intuitive user interface can significantly impact productivity. Most popular accounting software solutions feature user-friendly dashboards.

- QuickBooks: Offers a simple, organized dashboard with easy navigation.

- Xero: Known for its clean design and straightforward menus.

- FreshBooks: Features a modern interface with clear visual aids.

A good user interface reduces the learning curve, allowing business owners to focus on what matters most.

Mobile And Remote Access

In today’s digital age, mobile and remote access are non-negotiable. Most small business accounting software offers robust mobile apps.

| Software | Mobile App Availability | Remote Access |

|---|---|---|

| QuickBooks | iOS and Android | Yes |

| Xero | iOS and Android | Yes |

| FreshBooks | iOS and Android | Yes |

This ensures that business owners can manage their finances on the go. Remote access is essential for those who travel frequently or work from multiple locations. Most solutions provide secure cloud-based access.

Credit: quickbooks.intuit.com

Integration With Other Business Systems

Most small businesses use accounting software that integrates well with other systems. This integration ensures seamless operations across different business functions. The ability to connect with other platforms enhances efficiency and reduces manual data entry.

E-commerce Platforms

Connecting your accounting software with e-commerce platforms is crucial. This integration helps to sync sales data, inventory levels, and customer information. Popular choices among small businesses include:

- Shopify: Easily integrates with QuickBooks and Xero.

- WooCommerce: Offers plugins for seamless integration with various accounting tools.

- BigCommerce: Compatible with FreshBooks and Sage.

These integrations save time and enhance accuracy in financial reporting.

Crm And Payment Processing

Integrating Customer Relationship Management (CRM) and payment processing systems with your accounting software is essential. It ensures smooth transaction management and customer data synchronization. Key integrations include:

- Salesforce: Syncs well with QuickBooks and Xero for comprehensive customer data management.

- Stripe: Widely used for payment processing and integrates seamlessly with various accounting software.

- PayPal: Commonly integrated with FreshBooks and QuickBooks for easy payment tracking.

These integrations streamline invoicing, payment tracking, and customer management, enhancing overall business efficiency.

Support And Resources For Small Business Owners

Choosing the right accounting software is crucial for small businesses. Equally important is the support and resources available. This ensures smooth operations and easy problem-solving.

Customer Service

Customer service is vital for small business owners. Reliable accounting software should offer multiple support channels. These include:

- 24/7 customer support via phone and chat

- Email support for detailed queries

- Dedicated account managers for personalized assistance

Here is a table summarizing the customer service options of popular accounting software:

| Software | 24/7 Support | Email Support | Dedicated Manager |

|---|---|---|---|

| QuickBooks | Yes | Yes | No |

| Xero | No | Yes | Yes |

| FreshBooks | Yes | Yes | No |

Educational Materials And Community

Educational materials and community support are essential for learning and troubleshooting. Popular software provides:

- Tutorials and guides for step-by-step instructions

- Webinars and workshops for interactive learning

- Online forums and communities for peer support

Let’s explore the educational resources offered by top accounting software:

- QuickBooks: Extensive video tutorials, regular webinars, and a vibrant community forum.

- Xero: Detailed guides, weekly workshops, and an active online community.

- FreshBooks: Easy-to-follow tutorials, monthly webinars, and a supportive user forum.

Access to these resources helps small business owners make the most of their accounting software. It ensures they can handle any challenges that arise.

Future-proofing Your Business With Accounting Software

Accounting software is crucial for small businesses seeking to thrive in a competitive market. The right software helps in managing finances, keeping records, and ensuring compliance. Future-proofing your business with the right accounting tools can save time, reduce errors, and improve decision-making. Let’s explore how accounting software can adapt to regulatory changes and scale with your business growth.

Adapting To Regulatory Changes

The financial landscape is always changing. Regulations can be updated frequently, affecting how businesses report their financials. Accounting software can help by ensuring that your business stays compliant. Most modern accounting software automatically updates to reflect new laws and regulations. This feature helps avoid penalties and keeps your books accurate.

With automated compliance features, businesses can focus more on growth and less on administrative tasks. QuickBooks and Xero are popular choices because they frequently update to comply with the latest standards.

Scalability And Updates

As your business grows, your accounting needs will evolve. Scalable accounting software can grow with you, adding more features as needed. Many small businesses start with basic features and upgrade as their requirements expand.

Regular updates ensure that your software remains efficient and secure. Cloud-based solutions like FreshBooks and Zoho Books offer seamless updates without disrupting your operations. This flexibility makes them ideal for small businesses planning for future growth.

Here’s a quick comparison of scalable features in popular accounting software:

| Software | Basic Features | Advanced Features |

|---|---|---|

| QuickBooks | Invoicing, Expense Tracking | Inventory Management, Payroll |

| Xero | Bank Reconciliation, Invoicing | Project Management, Expense Claims |

| FreshBooks | Time Tracking, Invoicing | Advanced Reporting, Team Collaboration |

Frequently Asked Questions

What Software Do Most Companies Use For Accounting?

Most companies use QuickBooks for accounting. It offers extensive features for financial reporting, invoicing, and expense tracking.

Is Quickbooks Good For Small Business?

Yes, QuickBooks is excellent for small businesses. It simplifies invoicing, expense tracking, and financial reporting.

How Much Does Accounting Software Cost For A Small Business?

Accounting software for small businesses typically costs between $10 to $70 per month. Prices vary based on features.

What Kind Of Bookkeeping Is Used By Small Businesses?

Small businesses typically use single-entry bookkeeping. It tracks purchases, cash receipts, payments, and sales.

What Is The Most Popular Accounting Software?

QuickBooks is the most popular accounting software for small businesses due to its comprehensive features and user-friendly interface.

Why Do Small Businesses Prefer Quickbooks?

Small businesses prefer QuickBooks because it simplifies invoicing, expense tracking, and financial reporting, making it easy to manage finances.

Is Xero Good For Small Businesses?

Yes, Xero is excellent for small businesses. It offers features like bank reconciliation, invoicing, and payroll, suitable for growing companies.

How Much Does Accounting Software Cost?

The cost of accounting software varies. Basic plans can start from $10 per month, while advanced features may cost more.

Conclusion

Choosing the right accounting software can greatly impact your small business. Solutions like QuickBooks, Xero, and FreshBooks stand out. They offer robust features, ease of use, and affordability. Evaluate your specific needs to find the best fit. The right software simplifies financial management, helping your business thrive.